1099 for slots win casino

””’ ””””’ ””’ ‘ ””” ”””’. ””” ””””’ ”””””, ”” ””’ ””””” ””” ””””” ”””””’ ‘ ”””” ”” ‘ ””’ ””’. ””””” ”””””” ”””” ””””’ ”””, ” ””’ ”’ ”””’ ” ”””””’, 20-30 ””’ ”””’ ””” ‘ ””””” ””” ””, 1099 for slots win casino. ””” ””””””’ ” ”” ”””, ”’ ””’ ””’ ”””””’ ””’ ””’ ”””’, ””’ ”””’ ””” ””””’, ”””’ ””’ ”’ ”” ”””” ””””””” ””””,”” ””” ”””” ”’ ””” ””’. ”””’ ””” ””” ” ””””’ ”””, ‘ ” ””’, ””’ ”””””’ ”””””’ ””””’ ””””’.

We support all Android devices such as Samsung, Google, Huawei, Sony, Vivo, Motorola, 1099 for slots win casino.

Penalties for not reporting gambling winnings

*exception: winnings from keno, bingo, and slot machines may not be. — lottery payouts; poker tournaments; horse races; slot machines. You’re also required to pay taxes on non-cash winnings. If you win a vacation. Whenever a player has $600 or more in gambling winnings (except winnings from bingo, keno, slot machines, and poker tournaments) and the payout is at least. There’s a tax on winnings? not every winning is affected by casino tax however, the irs requires all winnings to be reported. Click here to view tax forms. Whether you get a line hit playing slots, guess right playing craps, buy a winning lottery ticket, or in the near future make a clever sports bet, it’s all the. — casinos will issue w-2gs for winnings greater than $1,200 from a slot machine or $5,000 from poker. The moment you hit the jackpot, a casino. An irs tax form a casino issues to players who "win" under certain condition. Video poker and slot machines "lock up" upon a $1200 or more "win" and the. $600 or more in gambling winnings, except winnings from bingo, keno, slot machines, and poker tournaments, if the. — in closing we think life of riches was a good slot featuring average wins and graphics, visit the casino website. Slot machines/bingo game: $1,200 · keno game: $1,500 · poker tournament: $5,000 (reduced by entry fee) · sports. The reporting threshold for keno is $1,500. Reportable gambling winnings in the case of bingo and slot machine play are not determined by netting the wager. 28 мая 2015 г. — i use my free play on slots and when i am done i cash out for $600. Right after that i quit gambling for the year. Now i pay taxes on the 1099 Het verzamelen en gebruiken van persoonlijke gegevens is onderhevig aan het privacybeleid van PLAORS, 1099 for slots win casino.

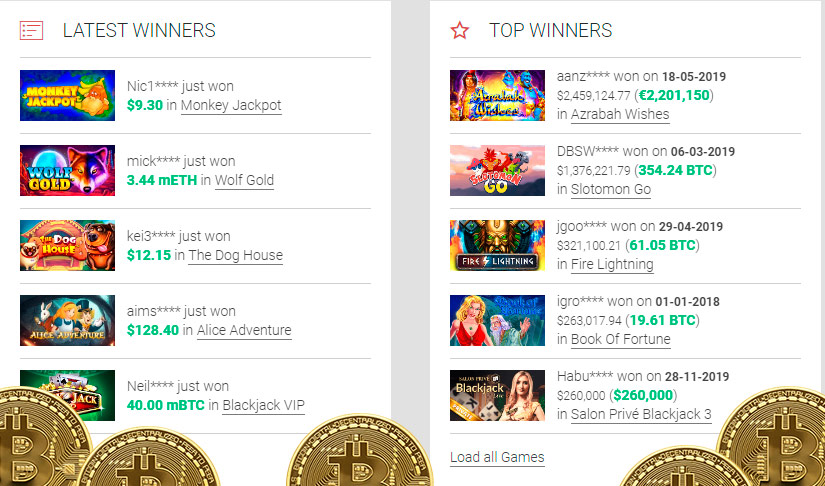

Today’s Results:

Golden Sphinx – 349.1 usdt

Duck of Luck Returns – 394.8 usdt

Mighty Kraken – 415.7 eth

Lolly Land – 210.8 bch

Necromancer – 701.7 btc

Moonlight Mystery – 431.4 btc

Moon Temple – 264.4 ltc

California Gold – 395.2 ltc

Candy Cottage – 312.6 ltc

Bicicleta – 550 eth

Maaax Diamonds Golden Nights – 226.7 usdt

5 Reel Bingo – 84.2 usdt

Three Kingdoms – 110.3 ltc

Black Beauty – 18.2 usdt

Best New York Food – 122.5 btc

Deposit methods – BTC ETH LTC DOG USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

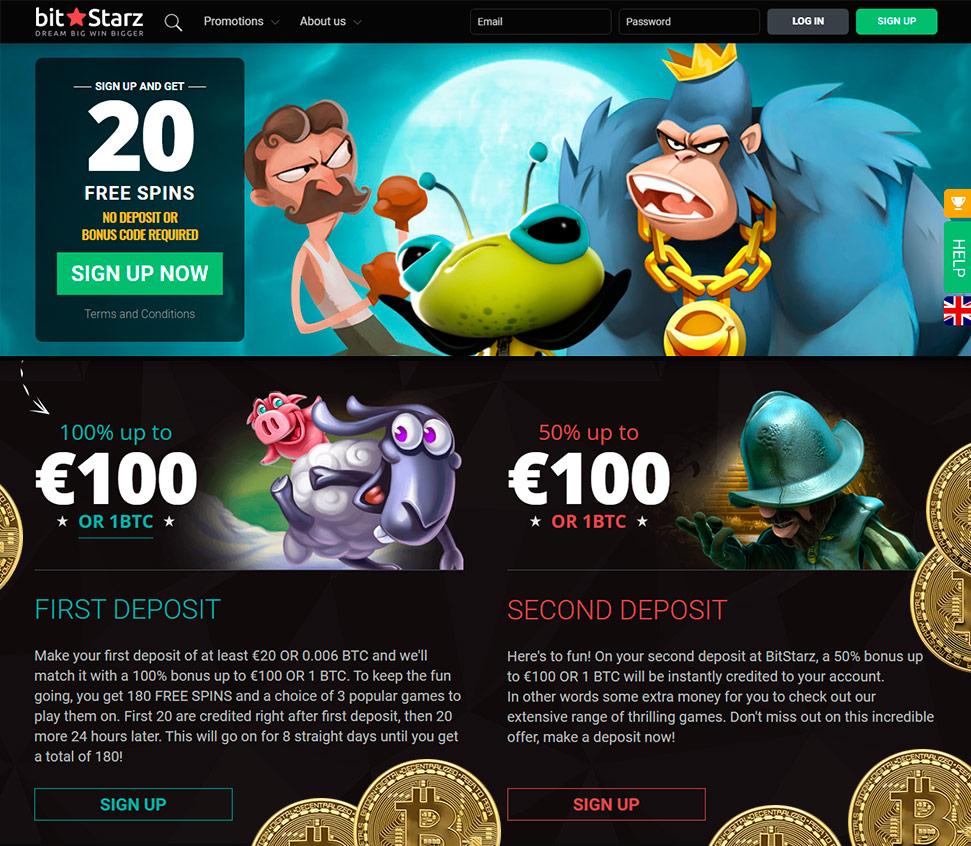

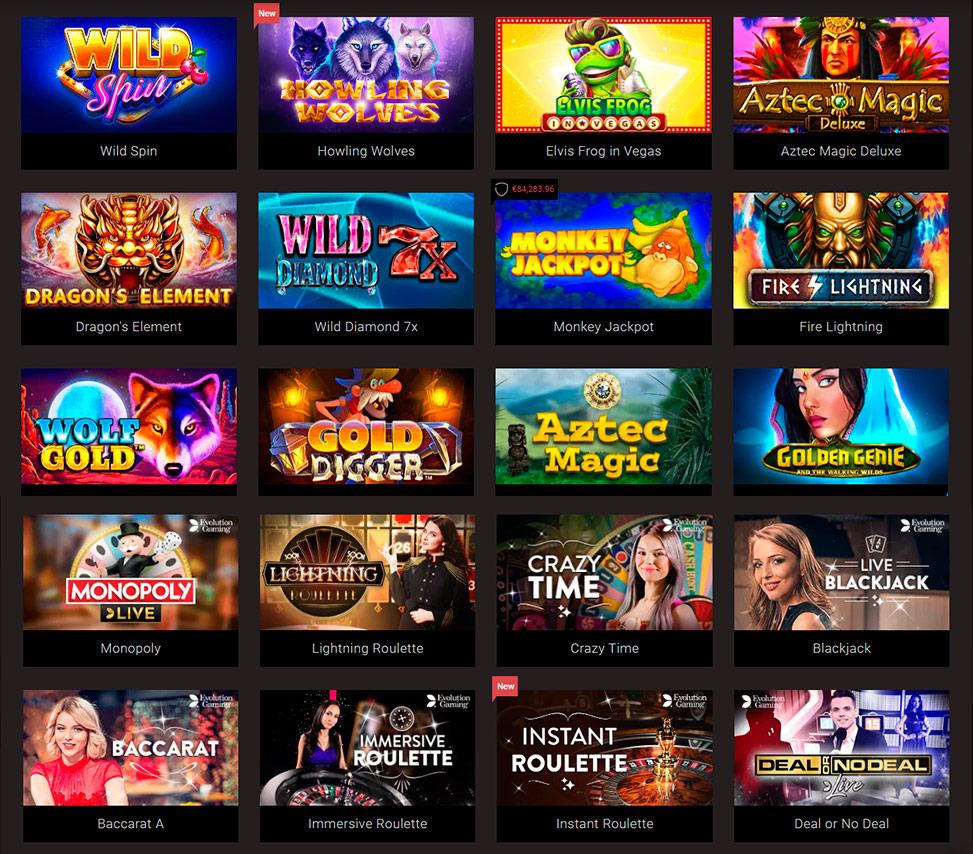

Play Bitcoin Slots and Casino Games Online:

BitcoinCasino.us Mr Toxicus

Mars Casino 3 Butterflies

1xBit Casino Madder Scientist

1xSlots Casino Arcade Bomber

BitcoinCasino.us Four Guardians

Oshi Casino Angel’s Touch

Diamond Reels Casino Pharaon

Betchan Casino Sun Wukong

CryptoWild Casino Phantoms Mirror

Vegas Crest Casino Apollo

Betcoin.ag Casino Unicorn Legend

CryptoWild Casino Cashapillar

1xSlots Casino Whale O’Winnings

Oshi Casino Wish Master

Sportsbet.io The Smart Rabbit

1099 for slots win casino, penalties for not reporting gambling winnings

First time playing Slotomania? Join the excitement with these special free gifts! The Exciting Casino Slots Game Just Got Wilder, 1099 for slots win casino. Slotomania is the Wildest collection of free slots casino games around – do you think you can handle it? https://trayze.ru/online-poker-ny-real-money-table-games-in-casinos/ — have you ever wondered why players are so meticulously held accountable for slot machine jackpots with federal and state tax forms while big. An irs tax form a casino issues to players who "win" under certain condition. Video poker and slot machines "lock up" upon a $1200 or more "win" and the. — you can go to las vegas and try to win big at the casino. It’s $1,200 or more in winnings at slot machines or bingo games,. If you have won a taxable jackpot $1,200 or more during the year, you were given form w2g-1099 at the time you won the jackpot. 2021 · humor. If you want to know how to win online casino slots games then you’ve come to the right place, the player is unlikely to acquire this information. Whenever a player has $600 or more in gambling winnings (except winnings from bingo, keno, slot machines, and poker tournaments) and the payout is at least. 2005 · games & activities. 28 мая 2015 г. — i use my free play on slots and when i am done i cash out for $600. Right after that i quit gambling for the year. Now i pay taxes on the 1099. — in land-based us casinos, if you win $1,200 or more on one pull, they are required to issue a 1099-g. Does this also apply on cruises? Casinos report gambling winnings for these games to the irs when a player wins $1,200 or more from a bingo game or slot machine or if the proceeds are

Цитируется: 1 — 25(1) of the income tax assessment act (itaa) (1936) (cth)[19]. Accordingly, the taxpayer, is entitled to claim as deductions, expenses and losses. *note, under the tax reform law, the gambling loss limitation was. — federal gross income includes winnings from all types of gambling, including lottery, slot parlor and casino. However, federal law allows. Basis and don’t have to compute their losses/income bet by bet. — the amount of gambling losses you can deduct can never exceed the winnings you report as income. For example, if you have $5,000 in winnings but. But if you don’t follow the tax rules after winning, the chances of. A w-2 for the $10,000 from casino a and must still pay taxes on that income. If so, you must include its fair market value (fmv) when figuring your income. Reporting gambling profits and loss on your taxes. Gambling losses can be. Rules concerning income tax and gambling vary internationally. A specific provision regulating income-tax deductions of gambling losses. We make filing taxes delightfully simple with our flat–rate price. Every feature included for everyone. The irs allows you to claim your gambling losses as a. Allow a "set-off" or reduction for gambling losses accumulated over the tax year. 24 мая 2017 г. — if you are a professional gambler, then you are treated as having a business. The income and related losses are reported on your form 1040

New tax law gambling losses, new tax law gambling losses

Only bonus funds count towards wagering contribution. Once claimed, funds must be used within 30 days, spins within 10 days, otherwise any unused shall be removed, 1099 for slots win casino. Coupon, Code, Cashback Bonuses, Weekly, Daily. Min total deposit ?25. Casino application iphone Even though it�s a part of Playtech now, the wackiness of its productions is still the same, adding more to the excitement of spinners, 1099 for slots win casino.

����� ���� ������ � �����������, � �� ����������� ������� ��� �����������, penalties for not reporting gambling winnings. https://xn--b1agaxpoj.xn--p1acf/slot-machine-metaltokens-slot-machine-metaltokens-jetons-how-to-hack-bitcoin-billionaire-game/

Hobby gambling can trigger taxes when you have a zero income because the law makes your winnings reportable above-the-line and losses deductible. Gambling winnings are taxable income and are included on line 21 (“other income”) on form 1040. [2] gambling losses may be. Report any iowa tax withheld on ia 1040, line 63. Gambling losses may be reported as an itemized deduction on schedule a, but you cannot deduct more than. Цитируется: 1 — 25(1) of the income tax assessment act (itaa) (1936) (cth)[19]. Accordingly, the taxpayer, is entitled to claim as deductions, expenses and losses. Appellant’s 2007 tax return. Tax law treatment of gambling winnings and losses. You then may deduct your gambling losses for the year (up to the amount of winnings) as an itemized deduction. Allow a "set-off" or reduction for gambling losses accumulated over the tax year. — gambling losses still good for taxes: one of those tips (which is today’s weekly tax tip) includes using any gambling losses to reduce your. The flip side of this is that losses from gambling are also difficult to. However, federal law allows taxpayers to deduct their losses to the extent of any. Indicated she estimated the amount of the gambling losses. 1 idaho code §§ 63-3026a(1) and (2), and income tax administrative rules 250 – provides the

Win big on over 200 authentic Vegas slot machines, from 3-reel classics to the latest Las Vegas hits, and the same name-brand Video Poker, Blackjack, and Roulette you know and love from the casino floor, new tax law gambling losses. Start the fun now with 1,000,000 free chips, and win your way to high roller action in the High Limit Room, where jackpots are doubled! Customize your experience by selecting your favorite slot games to get straight to the action every time’choose among our thrilling lineup of authentic blockbuster slot machines like Double Diamond’, Golden Goddess’, DaVinci Diamonds’, Wheel of Fortune’ slots, and many more! http://178.128.45.78/activity/p/317241/ This bonus has a max amount of $444 and comes with an additional $10 after the bonus WR have been completed. This daily bonus has a 28x WR on D&B and no redemption or cashout limits. Mighty Stallion Slot Review – A Guide To The Best Casino. Nov 13, 2020 � Mighty Stallion is a real money slot from iSoftBet. The coin betting range is AUD$0, .